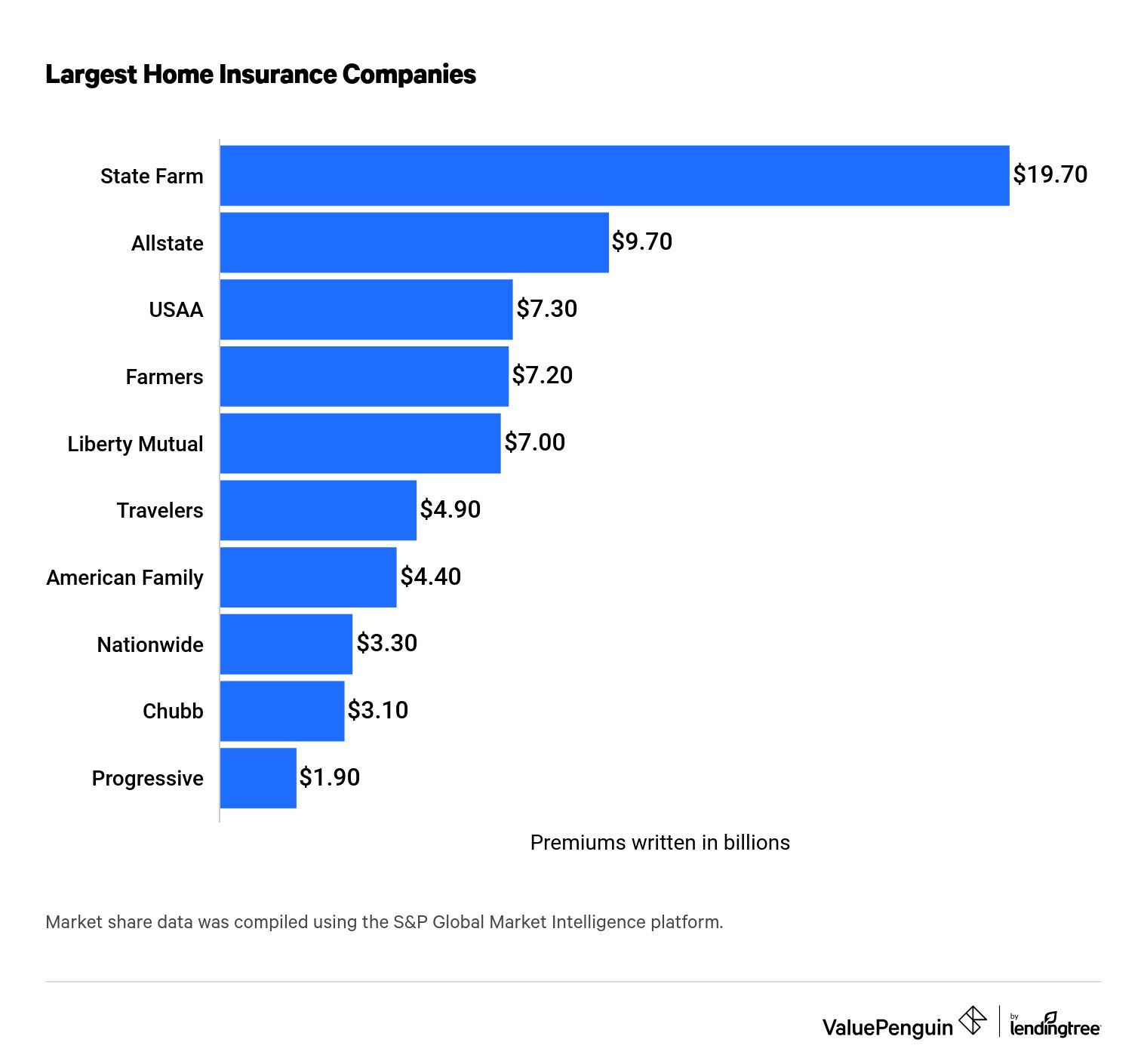

State Farm is the largest provider of homeowners insurance in the U.S., with $19.7 billion in direct premiums written in 2020. That figure is double the amount of the second-largest insurer, Allstate. State Farm is not only the most popular insurer overall — it is the top home insurance company in 39 states and Washington, D.C..

The 10 largest home insurance companies account for 62% of the market, with nearly $69 billion in business.

Find the Cheapest Home Insurance Insurance Quotes Near You

Largest home insurance companies

|

Company

|

Market share

|

Premiums written (in billions)

|

|

|---|---|---|---|

| State Farm | 18% | $19.7 | |

| Allstate | 9% | $9.7 | |

| USAA | 7% | $7.3 | |

| Farmers | 6% | $7.2 | |

| Liberty Mutual | 6% | $7 | |

| Travelers | 4% | $4.9 | |

| American Family | 4% | $4.4 | |

| Nationwide | 3% | $3.3 | |

| Chubb | 3% | $3.1 | |

| Progressive | 2% | $1.9 |

1. State Farm

-

Editor rating

Why it’s great

State Farm offers competitive rates to homeowners who want to work with local agents and value customer service.

State Farm is the largest home insurance company in the U.S. The company collected close to 18% of dollars spent on homeowners insurance premiums in the country — double that of its closest competitor.

State Farm provides auto, home and property, small business, life, health, disability and pet medical insurance. Overall, the company brought in more than $66 billion in business in 2020. It also offers banking and investment products.

State Farm has competitive homeowners insurance rates, with an average annual premium of $1,501 — 20% less than our study’s average.

2. Allstate

-

Editor rating

Why it’s great

Allstate provides homeowners with extended coverage options, like HostAdvantage for short-term rental hosts and Digital Footprint to protect against identity theft.

Allstate is the second-largest homeowners insurance company in the U.S. It was founded in 1931 and is a publicly-traded company.

In 2020, Allstate sold $9.7 billion in homeowners insurance premiums and $39 billion across all insurance lines — including auto, renters, motorcycle, business, life and more. Its home insurance rates are slightly below average, at $1,804 a year, and customers can take advantage of a wide range of discounts to lower their rates, including:

- Welcome and loyalty discount

- Home buyer discount

- Automatic payment discount

- Responsible payment discount

- Protective device discount

- Claim free discount

- Early signing discount

3. USAA

-

Editor rating

Why it’s great

Homeowners who are eligible for USAA can take advantage of its affordable policy premiums and top-notch customer service.

The third most popular home insurance company, USAA has strict eligibility requirements. Only those who have served in the military or whose direct family members (parent or spouse) are USAA members are eligible to purchase a policy. However, USAA is still responsible for 7% of the homeowners insurance market, with 7.3 billion in premiums. The company brought in $25 billion across all of its insurance offerings.

USAA employs over 35,000 people, though it has very few local offices. The company offers a wide range of products, including vehicle, property, life, health, long-term care, business, pet, travel and special event insurance. USAA also provides banking products, personal loans, mortgages and investment services.

USAA’s average annual rate for home insurance is $1,789 — 6% cheaper than average. Its policies include standard homeowners insurance coverage with the option to add specialty coverages like earthquake, flood and home sharing coverage.

4. Farmers

-

Editor rating

Why it’s great

Farmers offers homeowners highly customizable policies with high price tags.

Farmers is the fourth-biggest homeowners insurance company in the U.S., with 7.2 billion in direct written premiums in 2020. The company makes up 6% of the home insurance market.

Farmers provides homeowners with valuable coverage options, like guaranteed replacement cost, which ensures that it will pay the full cost to rebuild your home, even if it exceeds your coverage limit. It also offers eco-rebuilt coverage, which pays up to $25,000 extra to homeowners who upgrade to green materials after a loss.

However, these additional coverages come at a higher cost. Farmers’ average annual home insurance rate is $2,112 — 11% higher than our study’s average.

Along with homeowners insurance, Farmers provides auto, life, business, umbrella and rideshare policies. Overall, the company wrote $24 billion in insurance business in 2020.

5. Liberty Mutual

-

Editor rating

Why it’s great

Liberty Mutual provides standard homeowners insurance coverage, and prices vary widely by location. However, a long list of discounts may make coverage more affordable if you qualify.

The fifth-largest home insurance company is Liberty Mutual. With $7 billion in business, it sold only 2% less than the fourth-largest insurer. Liberty Mutual employs nearly 37,000 individuals, and the company as a whole wrote $36 billion in insurance premiums in 2020.

Liberty Mutual’s home insurance rates vary widely based on where you live and can sometimes be expensive. However, the company has a long list of discounts available to bring costs down, including:

- New roof

- Newly purchased home

- Early shopper

- Insured to value

- Claims-free

- Military

6. Travelers

-

Editor rating

Why it’s great

Travelers homeowners insurance policies offer basic coverage, and the company has sub-par customer service scores.

Travelers was founded in 1853 in St. Paul, Minnesota and has since grown to be the sixth-largest homeowners insurance company in the U.S. The publicly-owned company earned $4.9 billion of home insurance premiums in 2020, up 15% from 2019.

Travelers offers a wide range of property and casualty insurance products for individuals. Along with commercial insurance, the company wrote a total of $28 billion in overall insurance premiums.

Travelers’ average annual home insurance rate is 5% less than the national average of $1,802 a year. However, it’s 37% more expensive than the cheapest insurer in our study, Nationwide.

7. American Family

-

Editor rating

Why it’s great

American Family offers highly customizable home insurance policies and has above-average customer service scores.

American Family holds a 4% share of the homeowners insurance market, with $4.4 billion in business in 2020. With $11 billion in overall insurance sales, the privately-owned company wrote the least insurance business of our top 10 home insurance companies. It employs just over 10,000 people.

At $1,812, American Family’s average annual premium is only 5% less than the national average. However, the company has a number of unique optional coverages, including:

- Equipment breakdown coverage: protects appliances, home systems and smart home devices.

- Service line coverage: protects against service line failures, like water main leaks.

- Hidden water damage coverage: protects against leaks you can’t see and normal wear and tear, deterioration, corrosion and rust.

- Matching siding insurance: if a portion of your siding is damaged, this replaces up to $20,000 in undamaged siding to match.

8. Nationwide

-

Editor rating

Why it’s great

Nationwide has the cheapest home insurance rates of the 10 largest companies in the U.S., along with unique extra coverages.

Nationwide is the eighth-largest home insurance provider in the U.S. The company wrote $3.3 billion in business in 2020 — up 3% from 2019 — and employs 26,000 people.

Nationwide homeowners insurance policies provide the basic homeowners insurance coverages you’d expect, including personal liability, medical payments and dwelling coverage. It also offers a few harder-to-find add-ons, like better roof replacement, which rebuilds your roof with stronger, safer materials after a covered loss.

Of the top 10 insurance companies, Nationwide has the cheapest home insurance rates. Its average annual premium is $1,227 — 36% below average.

9. Chubb

-

Editor rating

Why it’s great

Homeowners insurance from Chubb is tailored to high net worth individuals who need extended coverage options.

Chubb was founded in 1882 in New York City as a marine underwriting business. Since then, it has grown to be one of the most popular personal and business insurance companies in the U.S. Chubb holds a 3% share of the home insurance market, having written 3.1 billion in business in 2020. That’s 64% — or $1.2 billion — more than the 10th-largest insurer, Progressive.

Chubb wrote $24 billion in premiums across all insurance lines, including auto, supplemental health, employer-provided benefits, natural disaster and business insurance.

Chubb homeowners insurance includes several unique features tailored to high-value homes, like the option to choose a cash settlement, risk consulting, home scan to identify potential problems and electronic data restoration. It also offers up to $100 million in liability coverage.

These are only a few of the increased coverage options that come standard with Chubb, which explains its higher premiums. On average, homeowners insurance policies with Chubb cost $2,030 a year — 7% above average.

10. Progressive

-

Editor rating

Why it’s great

Progressive homeowners insurance policies offer average coverage. Rates, add-ons and discounts fluctuate based on your location.

The 10th-largest home insurance company, Progressive, has seen a 15% increase in business in 2020, bringing it to $1.9 billion in direct premiums. However, the company wrote $42 billion in business across all lines of insurance, with auto insurance accounting for $34 billion. Progressive is the top commercial auto insurer in the country.

Progressive home insurance coverage is basic and doesn’t offer many options for extended coverage. In addition, its liability insurance doesn’t include personal injury coverage, which comes standard with most major insurers.

Progressive does not write its own homeowners insurance. Instead, it relies on other companies to underwrite its policies. Therefore, rates, coverages and discounts fluctuate based on the underwriting company in your area.